Business has always been a super competitive field. It’s hard to build and operate a successful company. But you also need to have constant grit and gumption to ensure long-term success.

A business owner must prioritize their core activities and focus. But it may not be possible when your people and resources are consumed by non-core activities.

That is why businesses are often better off delegating administrative supportive or operational functions to a third party. But before outsourcing a function, you should evaluate its contribution and impact on the company’s operations.

It’s because some non-core activities might also be direct contributors or closely aligned with your company’s core competencies.

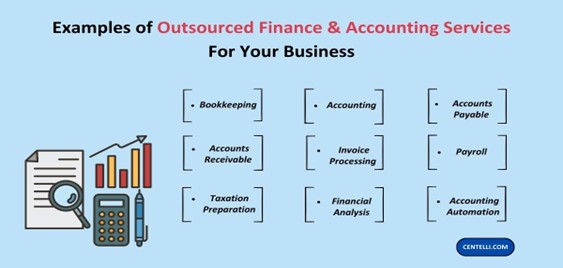

Significantly, finance and accounting outsourcing (FAO) can be an excellent move. Also, you may outsource an entire function, multiple processes, or a single process, as required.

Below are a few examples of finance and accounting functions that businesses typically outsource. Let’s explore these one by one and also check out the key benefits that come along.

1. Bookkeeping

Bookkeeping exercise is a must for every business aiming for good financial health. Whether you’re a large or small company, every financial transaction should be recorded on paper or in a digital format. Accounting software are mostly used nowadays!

Every significant detail like cash or cheque payment or receipt invoices, bills, and credit sales (or purchases) goes into the books of accounts. Other key activities include bank reconciliations and financial report generation.

However, these tasks are repetitive, routine, and time-intensive. By outsourcing bookkeeping, business owners can free up their staff and paraphernalia and use them elsewhere. For example, you can redirect them to core activities and more valuable tasks.

2. Accounts Receivable and Accounts Payable

You can choose to outsource your accounts receivable (AR) and accounts payable (AP) functions to an external provider. AR and PR entail tracking a business’s incoming receipts and outgoing payments respectively.

The service provider executes and manages tasks like invoicing, billing, payment collection, etc. These processes demand regularity and timeliness. They become more and more complex as the business grows and you’ve more customers and vendors on board.

By appointing an efficient service partner, you can achieve a seamless accounts receivable and accounts payable functions, which are fast and error-free.

3. Payroll Processing

Your employees are crucial to your business success. A robust payroll system ensures they’re happy. So, you can appoint an expert payroll processing service to manage it for you.

The service provider takes of all payroll-related tasks, including calculating employee salaries or wages applicable deductions, medical and insurance, and other benefits and perks. Aside from generating paycheques, they can also help with tax preparation and filing.

Payroll processing can be complex and time-consuming, especially for large enterprises. However, it can as troublesome for all businesses during tax season. Outsourced payroll processing ensures you’ve an up-to-date payroll process in place.

4. Financial Reporting

Financial reports enable you to look at the big picture and also get into the finer details about your business’s financial health at any given point in time. If you’ve expert financial services to manage the financial reporting, you can rest assured of its findings.

An expert summary of your business performance enables business owners and managers to make informed decisions about the company’s future course. Outsourced financial reporting can ensure that the report generation activity is timely and standardized. It also helps businesses comply with all applicable financial reporting norms.

5. Taxation

Registered businesses are liable to federal or state taxes. Needless to say, tax preparation and filing tasks are complex and strenuous for small as well as large businesses. Errors and delays can put you in a tough situation where penalties or other complications may arise.

By outsourcing taxation to a specialist tax services provider, you can ensure that tax returns are prepared accurately and filed on time. As such, your businesses shall be on top of compliance always.

6. Budgeting and Forecasting

Business owners need to think ahead, to keep up with market fluctuations, and emerging opportunities and challenges. Budgeting and forecasting help you make financial plans for the future. The process involves revenue and expense estimations, financial goal setting, and tracking progress.

Your outsourced service provider can provide you with accurate and up-to-date budget and forecast processes for better analysis.

As such, you’ll be able to take the right decisions at the right time, enabling efficient allocation of resources and efforts for further growth.

7. Financial Analysis

An accurate financial analysis can help your business avoid risks and tap into profitable opportunities.

If you’re a business or accounting firm looking for reliable FAO services, you can consider Centelli. We’re a UK company mainly serving Europe, India, and the United States. We offer result-bearing, scalable accounting outsourcing solutions to businesses of all sizes. Click to Contact us for a Free Consultation and Quote now!

An expert financial analysis service provides accurate reports backed by deep understanding and care. Financial data thus prepared allows you to assess and interpret where your business stands and identify the areas of strength and improvement.

An outsourced specialist financial service can also support you with investment and financial strategies. You can access the expertise and resources you may not have in-house.

8. CFO Services

Outsourced chief financial officer, or CFO services are highly specialized. These C-level services can help you with key business, finance, accounting, and operational decision-making.

The CFO service takes care of all the top-level strategic financial decisions, such as financial planning, budget planning treasury management, risk management, etc. They also aid you during business restructuring, funding, or expansion efforts.

Only well-qualified and seasoned CFO outsourcing services can provide you with the required expertise and know-how.

Factors to Consider While Outsourcing Finance and Accounting

A qualified FAO service provider can help you improve both accuracy and efficiency of your financial operations.

Looking for reliable and transparent FAO services partner to help improve your productivity and efficiency? You can leverage a wide range of outsourced financial and accounting solutions from Centelli to achieve your goals. Explore our F&A services portfolio here!

However, you should carefully select which are the processes and subprocesses that can be outsourced. It’ll help you maximize your finance and accounting outsourcing benefits.

Here’re the 7 golden rules you need to keep in mind:

- Your business’s needs, priorities, and goals

- The level of expertise you require

- Your budget

- Potential FAO service partner’s standing and experience

- Range of services offered and pricing

- Scope of customization if you seek a solution to a specific problem

- Service provider’s security and compliance capability